Pakistan is facing economy fall down due to the budget deficit which is causing an increase in the inflation. Pakistan economy is getting collapse and causing less opportunities to the people of Pakistan. While focusing on this problem, Imran Khan Leader of Pakistan is negotiating with the foreign alliances for their supportive friendly approach to boost up Pakistan cash reserves, economy and supporting the people which they been in inequality and stress unless this opportunity might possible to boost up Pakistan economy with the help of our neighbor countries are standing with to support us.

Saudi Arabia Pledges to provide US $6 billion for Pakistan in Financial Crisis:

The Saudi Arabia gave a relief package to maintain Pakistan’s Balance of Payment (BOP) debit after Prime Minister Imran Khan visited to Saudi Arabia.

Leader Minister Imran Khan travelled to Riyadh on the invitation of King Salman bin Abdul Aziz to join in the Future Investment Initiative (FII) Conference in October, 2018.

The much needed inflow came at a point when Pakistan and the International Monetary Fund (IMF) were negotiating a bailout package.

Imran Khan(Prime Minister of Pakistan) and the Pakistan Economical Team managed to settle down a financial package worth US $6 billion dollars from Saudi Arabia. The Kingdom had also agreed to provide Islamabad which included. US $3 billion dollars for the Balance of Payment (BOP) Support and another $3 billion US dollars for import of oil on deferred payments. The Kingdom(Saudi Arabia) had agreed to the $3 billion in Pakistan’s to set up a credit line worth $3 billion for the sale of petroleum goods on credit for 3 years with the interest return rate of 3.18% annually.

According to a press release issued by the regime, several far reaching decisions on bilateral economic and financial cooperation reached during the negotiations held between Pakistani and Saudi officials:

- It was agreed that Saudi Arabia will provide US $3 billion for a time of one year as Balance of Payment(BOP) Support. A Memorandum of Understanding(MoU) was signed in this hold between the Finance Minister Asad Umar and his Saudi counter-part Muhammad Abdullah Al-Jadaan.

- It was also certain that a one year deferred payment facility for the import of oil will be up to $3 billion and that will be provided by the Riyadh. This deal will be in place for 3 years, after that which it will be reviewed.

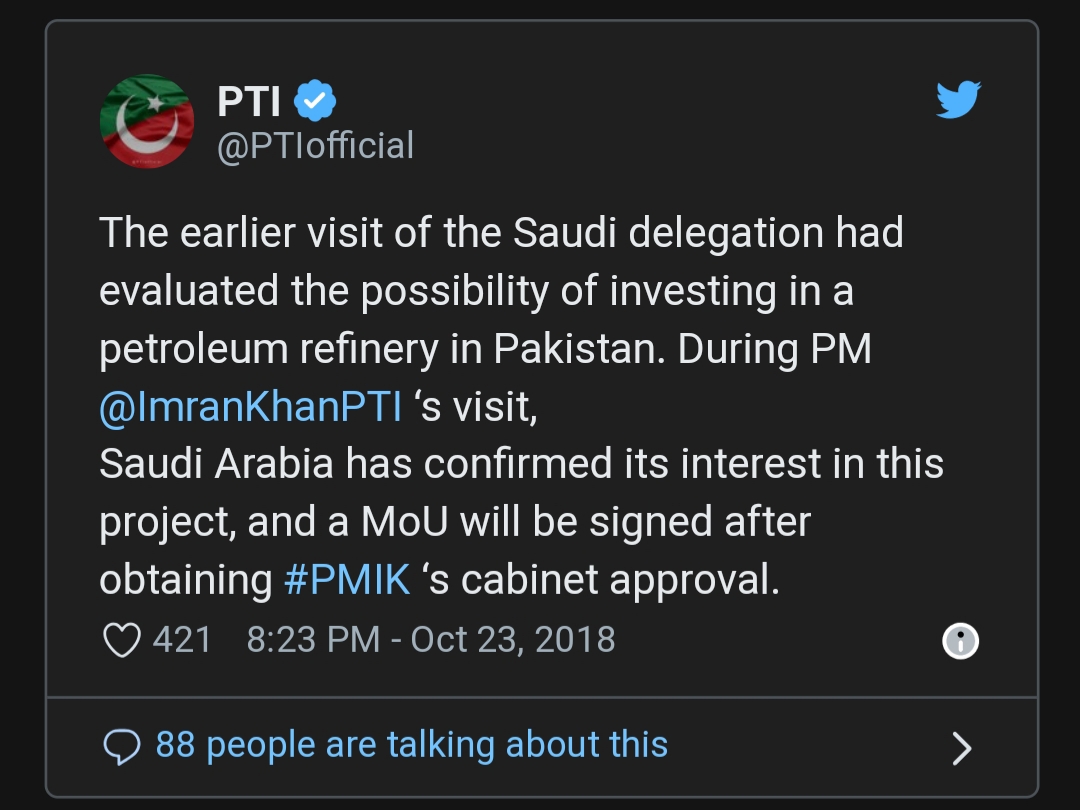

- Saudi Arabia also established its interest rate in investing in petroleum refinery in Pakistan. An MoU for this project will be signed after obtaining the cabinet’s support.

- The Kingdom also spoken some interest in the growth of mineral assets in Pakistan. The federal regime of Pakistan will hold consultation with Balochistan government.

The Saudi energy minister Khalid al Falih said that it is setting up to $10 billion oil refinery while speaking on a visit to Pakistan’s Deep Water Port Project of Gwadar.

The increase in development came after Prime Minister Imran Khan visited Riyadh where he attended Future Investment Initiative Conference (FII) and met with the King Salman bin Abdul Aziz and Saudi Crown Prince Mohammad bin Salman.

Islamabad has been paying attention in attracting investment and other financial support to control the current account deficit, moderately caused by the rising of oil prices.

“Saudi Arabia wants to make Pakistan’s economic development stable through establishing an oil refinery and partnership with Pakistan in the China Pakistan Economic Corridor,” said the Saudi Energy Minister while talking to reporters in Gwadar.

Pakistan received $1 billion from Saudi Arabia, State Bank of Pakistan said:

SBP spokes man said, “The State bank has received $1 billion from the Saudi Arabia and $2 billion further will be received within a day or two.” on November 9, 2018, which provided support to the woes of the country.

“This understanding will be in place for three years, which will be reviewed later,” said the Foreign Office.

The first Saudi tranche will give a aid from economical pressure at the foreign exchange reserves and stable the price of the Rupee against US dollar.

Earlier, the reserves had been slight fast and dropped to a four and a half year low at $7.48 billion by November 9, 2018, according to the Central Bank.

Pakistan received its second installment of $1 billion from Saudi Arabia’s bailout package:

The second installment was received on Friday December, 14 2018

A State Bank of Pakistan’s official confirmed that the bank had received the amount from Saudi Arabia. And with this second installment, Pakistan’s foreign exchange reserves was located at 8.24 billion.

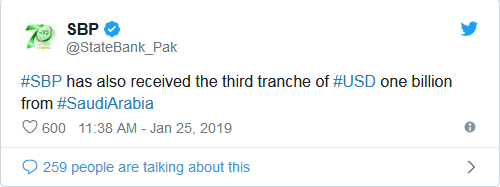

Pakistan receives Third/Last Tranche of $1 billion from Saudi Arabia:

Amount was received under an agreement signed on January 22, 2019 by Governor State Bank of Pakistan Tariq Bajwa and Director General of Abu Dhabi Fund for expansion.

The country’s foreign exchange reserves was positioned still at 9.24 billion with third installment from the Riyadh expected in January.

On its Twitter account, the State Bank of Pakistan confirmed that it has received the amount.

For Oil Imports:

Saudi Arabia’s promised deferred payment facility to Pakistan for the latter’s oil imports will thrust in from July 1, below which Pakistan will receive petroleum products worth $275 million every month, Radio Station reported on May 22, 2019.

Tweet by the Adviser to the Prime Minister on Finance Hafeez Shaikh, Radio Pakistan stated that Kingdom(Saudi Arabia) will export the petroleum goods worth about $3.2 billion to Pakistan every year for the next 3 years.

The Finance Adviser said that the facility will also Brace Pakistan’s Balance of Payments (BOP) Position, and thanked Saudi Crown Prince Mohammed bin Salman for his support for the people of Pakistan.

Minister for Planning, Development and Reforms Khusro Bakhtiar also hailed to news, adding up that the facility would have a positive result on the stock market.

In a statement, Bakhtiar said that the deferred payment facility will reduce the pressure outflow of foreign exchange. He also thanked the Saudi government for the facility.

“While Pakistan’s public external debt repayments are modest, low reserve adequacy threatens the ability of the government to finance the balance of payments deficit and roll over external debt at reasonable costs,” the agency said. It expects Pakistan’s total debt to reach 76% of GDP by 2020. At current, this debt stock stands at 72% of GDP, which is higher than the 58% mean for B-rated royals.

The loans has improved the country’s capability to pay for imports and opportunely pay off the future External Debt installments in the current fiscal year. Based on foreign exchange reserve information released by the State Bank of Pakistan (SBP), the deliverance of this amount should boost up Pakistan’s total reserves to around $14.75 billion.

The insecurity around the International Monetary Fund(IMF) package, which is very critical and major to take the country out of crisis, kept investors missing from the market in the second half of 2018. Foreign investors determined to devolve their shares in the market during last year.

China Giving Pakistan $3.5 Billion in Loans, Grants:

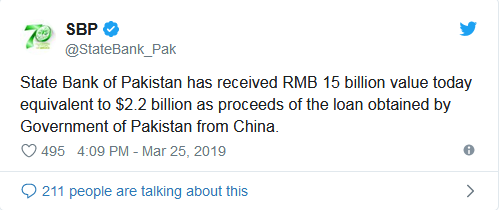

State Bank of Pakistan has received RMB 15 billion which is equal to $2.2 billion as income of the loan obtained by the regime of Pakistan from the China, said State Bank of Pakistan.

The Finance of Ministry spokesperson, Dr Khaqan Najeeb Khan, confirmed the deposit and said it will help contain the balance of payment situation and boost the country’s foreign exchange reserves.

In March, the Ministry of Finance had announced that the State Bank of Pakistan (SBP) would obtain a 15 billion Yuan(Chinese Currency) loan, equal to $2.1 billion from sociable Alliance China by March 25, 2019.

Dr Najeeb had said that all practical official procedure for the transfer of the loan being provided to Pakistan by the Chinese government have been completed, and the funds will be deposited in the State Bank of Pakistan (SBP) account on Monday, March 25.

Following a conference in Beijing between Chinese Leader Li Keqiang and Prime Minister Imran Khan in November 2018, China said that it was a willing to offer aid to Pakistan to help it whether its current fiscal woes, but that the terms of such assist were still being discussed. In response to a Financial Times report which China had pledged to a loan at least $2 billion to Pakistan to rise up its Foreign Exchange Reserves and keep away from more devaluation of the rupee against the dollar, Chinese Foreign ministry spokesman Lu Kang had uncertainly agreed that it was extending financial aid to help Pakistan.

Chinese Consul General Long Dingbin had said during an interview that in order to recover Pakistan’s Economy, Beijing is investing in many sectors and introducing the business ventures as an alternative of providing loans.

“The Chinese side has offered and will carry on to offer to its best through support, trade, investment and all around reasonable cooperation to support and boost/improve the Pakistan’s economic and social development,” Kang said in the statement.

At the time, it was the first official affirmation by a Chinese authorized that Beijing had planned to increase a financial package to Islamabad. The terms of the package had remained unclear.

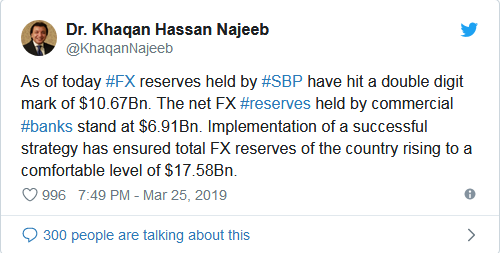

Furthermore, Dr. Najeeb said after receiving the Chinese loan for the foreign exchange reserves held by the State Bank of Pakistan (BOP) had hit the double-digit mark of $10.67 billion.

In a tweet, he added that the net foreign exchange reserves held by commercial banks stood at $6.91bn.

Implementation of a successful policy had resulted in the whole foreign exchange reserves of the country increasing to $17.58 billion.

This is a part of the government’s successful multi branched policy to make sure stability in its Balance of Payments (BOP), including present account deficit, improving remittances and ensuring sufficient foreign exchange financing. Foreign exchange reserves increased to a comfortable level.

The latest business lending by the China has pushed the gross official foreign exchange reserves to double digits after a year.

The State Bank said that Pakistan’s total foreign exchange reserves increased to $15.70 billion on March 15. These include $8.83 billion reserves held by the State Bank and $6.87 billion reserves available with the commercial banks.

The Financial Support Package for Pakistan is currently being worked out and it will be more than what inclusive by Saudi Arabia in terms of financial funding, Deputy Head of Mission at Chinese Embassy Zhao Lijian told reporters in November, 2018.

UAE signs $3bn support package for Pakistan:

Given the delay in the IMF loan program, UAE aid package sent a positive message to the investors, analysts had said.

After Saudi Arabia, the United Arab Emirates (UAE) deposited $3 billion US dollars into the Pakistan’s foreign currency account to overcome international payment crisis and to avoid a harsh International Monetary Fund (IMF) deal.

According to details, the decision to make official, the deposit was made under the commands of the President Sheikh Khalifa bin Zayed Al Nahyan, and Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces.

Mohammed Saif Al Suwaidi, Director General of ADFD, and Tariq Bajwa, Governor of the State Bank of Pakistan (SBP), signed the agreement at the ADFD headquarters in Abu Dhabi. Moazzam Ahmad Khan, Ambassador of Pakistan to the UAE, Khalifa Al Qubaisi, Deputy Director General of ADFD, and other senior government of the two parties attended the signing ceremony.

UAE signs off:

The UAE has announced its aim to deposit US $3 billion in the State Bank of Pakistan (SBP) to maintain the financial and monetary policy of the Islamic Republic of Pakistan, the Abu Dhabi Fund for Development (ADFD) said in a statement published by WAM news agency.

Pakistan and the United Arab Emirates (UAE) have finalized total of $6 billion support package to help the Islamabad to deal with its balance of payments challenge, the media reported on December 21, 2018.

The package involves total $3.2 billion worth of oil supplies on the deferred payment, besides a $3 billion cash deposit.

With this, Pakistan would get a total saving of about $7.9 billion on the oil and gas imports from the two countries (UAE and Saudi Arabia), accounting for more than 60% of annual oil import bill of about $12-13 billion.

This also included about $3.2 billion each of oil supplies on deferred payments from the UAE and Saudi Arabia and about $1.5 billion trade finance from the International Islamic Trade Finance Corporation (ITFC).

The total financing support from the UAE and Saudi Arabia, including the ITFC’s trade funding, would be around $14 billion when the cash deposits of $3 billion each from the two countries were also included, the official said.

Addition in transfer of oil refinery to be set up by Parco, joint project of Pakistan and Abu Dhabi worth $5-6 billion Petro chemical complex by Saudi Arabia.

Does Pakistan Economy need this?

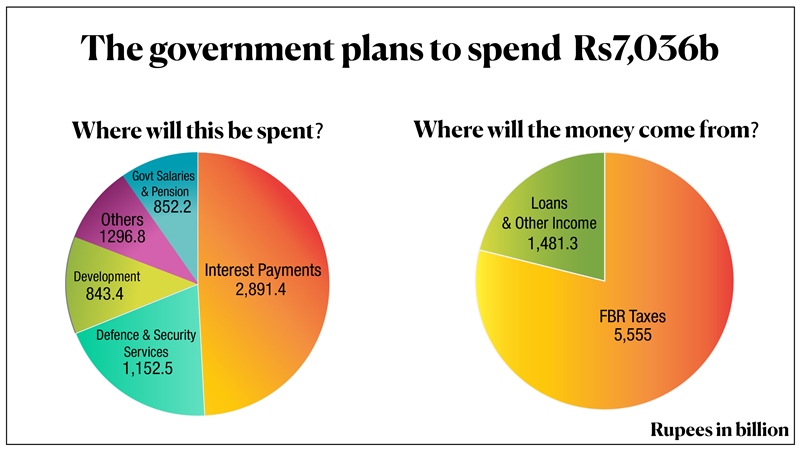

Among protests from the opposition, PTI led government presented its first annual budget, setting a 2.4% economic growth rate and double digit inflation forecast. June 18, 2019.

The government greatly needs money which typically comes from taxes and wants to control expenditure to struggle the twin deficits (Trade & Budgetary Losses) that are routing the economy towards a default.

After all the negotiation Imran Khan done with the foreign alliances which help keeping up the foreign exchange which is expected to be 17350.00 USD Million by the end of this quarter according to Trading Economics Global Macro Models. These loans from the foreign helped Pakistan to stabilize its economy and keeping less pressure on the people.

Hammad Azhar, minister of state for revenue, planned several new taxes and policy process that will not only make inflationary pressures but also slow down economic growth and keep the job market under pressure.

The government will also reduce withholding tax (WHT) on the purchase of property from 2% to 1%. On the other hand, it will charge WHT regardless of the property’s value in the past they charged WHT only on property worth more than Rs 4 million.

They have also increased minimum wage to Rs17,500 and abolished the 3% value addition tax on mobile phone imports. The raw material about 19 things used to make medicines will also be exempt from the 3% duty before charged from importers.

The government also sure to give tax incentives to employers willing to hire new former students those who graduated after June 1, 2017.

Conversely, the IMF loan comes with condition that require hurting reforms. This include dropping the fiscal and the trade losses, fixing or selling off loss making government companies and leaving the exchange rates free of the central bank’s involvement, even if the dollar goes up. Let’s cut through the economic terminology and know that the government needs to reverse growth to get there. When an economy grows, businesses expand and more jobs are created. People get promotions, salary increments and start spending money on food, clothing, recreation, automobiles and even houses. And all of this reverses, when it shrinks. This is exactly what the government is doing.